The Situation: The year 2020 has certainly not been a year for the investors or the equity market worldwide. All the major index of the world market let it be the Dow Jones, S&P 500, SGX-Nifty or the Nifty-50 has eroded all its gain of the last five or six years since the spread out of the Corona virus worldwide. Equity as an asset class has always compounded the principle of the investors throughout the years since its inception but it has always went through its vulnerable times like this.

Why the market is reacting to the COVID-19 pandemic?

To understand the market and to take the right step one need to understand the current situation the world is going through. This COVID-19 crises is certainly one of the most challenging threat the world has ever seen since its step to the modern era. While publishing this article there has been about 191,057 deaths worldwide and number of cases is about 2,725,487. The numbers are increasing every minute. Till now there has been no proven medicine or vaccine known to the mankind. Remember the 2008 market crisis was not an existential crisis it was a more of a financial crisis. Since the increasing case of the affected people kept on showing no resistance whatsoever the investors went into a panic selling mode to get back their money knowing the uncertainty forward. The world has never gone through such an extensive strict lock down ever that it is going through now, which certainly affected a lot of businesses worldwide. The small cap businesses will bear the biggest blow and they will lose most of their market share and by this the large caps will gain more. In turn the banking sector as a whole will gather a lot of NPA and this will affect their balance sheet and would definitely affect their lending capacity in the long run. Though the individual countries are bringing on more liquidity and issuing rate cuts to praise the market to avoid the economic depression but that will not bring in the stability unless a proven medicine arrives.

What is the trend that is going through in the market right now?

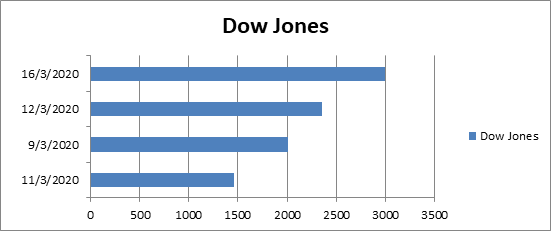

To understand this trend we need to go through the bellow chart which shows that how Dow Jones index has recorded its highest single day point losses in the history since the march 2020.

The US market has always been the market the whole world keeps an eye on since it is the world’s largest economy. But the above chart shows that investors react the same way whether they are trading in the worlds’ most stable economy or in some random economies. The Dow Jones recorded its highest single day fall on 16th march 2020. So as the NIFTY 50 recorded its highest single day fall on 23rd march 2020. Here is the India’s NIFTY 50 chart below of the first quarter of the 2020.

In between all these frightening data there is a hidden truth which most of the retail investors skip. We with our team when decoded the market trend in this crisis time we found that most of the big institutions and the big names are using this time as an opportunity to buy fundamentally strong businesses at lower rates with a SIP based approach. Remember you cannot get a business at a good price in its good time i.e. Good price and good time doesn’t go hand in hand. Now the million dollar question is if the market has reached the bottom or not! The actual answer to the question is not known to anyone. But we at modern creeds think that if the market corrects further then it may touch the 6000 -6500 in the NIFTY 50 chart. But timing the market should not be the approach of any ideal investor who seeks long term capital appreciation.

What does the historical chart teach us in this high time of market volatility?

Here by the historical chart of the NIFTY 50 index we can see after the market crash of 2008 when the market saw a correction of more than 50%, how the market recovered once everything got settled. And then through various ups and downs the market went on to hit 12000+ on the index. So those who kept their nerve cool and kept digesting the high volatility of the uncertain fate of the equity got rewarded in the long run. So if you are one of them who thinks the world will definitely recover from this crisis then you should keep the faith in this historical performance of the index.

What should be your golden approach to sail through this crisis and come out as a winner?

The data shows most of the retail investors fail to generate long term capital appreciation because of their wrong asset allocation and midway panic exit from their investment. This happens because of their uncertain goal and misconception of the equity market. We always suggest that while investing in the market there should be a proper allocation of investment in equity, debt and gold instruments. The proper blend of allocation actually helps the investors in this once a decade time of crisis. So, what we mean is if your goal is several years away and you know that this is not the end of the world then you should not exit or try to time the market. Instead a long term investor should use this opportunity to buy or accumulate fundamentally strong businesses in a SIP based manner. Further if you are someone who is investing through mutual funds then you should continue with your SIP and do not skip any of them especially in these times. Because in the long run when this COVID-19 crisis will get over all the investments made by you in this time will compound itself the most and will reward you in your journey to become financially independent.

All the best with your investment journey!

Disclaimer : Investing in equity market is subject to high volatility so you are always suggested to do your own research and take proper guidance from your financial advisor before investing.