After the stellar listing of the IRCTC IPO which just multiplied the investor’s money in its listing day itself, almost all the Indian retail investors were waiting for the country’s biggest IPO ever for the SBI backed company the “SBI cards and payments services”. The IPO came with a bid price of between Rs.750-Rs.755. The issue was certainly expensive since its P/E ratio was somewhere around 70+ back then. But the brokers had their explanation and reason behind its high valuations, which we think was valid to some extent. The IPO was advertised in almost every magazine, TV channels and on all digital media platforms. The issue was highly hyped that even the brokerage firms kept forwarding mails and thousand other notifications to its clients for subscribing to it. There was constant news that SBI Cards was having a grey market premium of about RS 300 and it was increasing each day, which made the investors more convinced about its IPO. But draining all its charm and hype, “SBI cards and payments services” listed on the market with a discounted price of Rs 665 to its issue price of Rs 755 on its debut.

What happened that all its charm faded right on the listing day?

The time when SBI cards listed, the market was already badly affected by the consequences of the spread of the coronavirus worldwide. Each day the NIFTY and SENSEX was getting the blow of panic selling from the majority. Large institutional selling pressure was also seen across all the segments. The time for the SBI cards to make its first trading session in the Dalal street could not have been worse than this. As the worldwide economy went into a lockdown stage and the infections of coronavirus kept rising, all the blue chips like the Titan, Bajaj Finance, Reliance Industries, HDFC Bank lost its share value by 30%-50% in a matter of days. This itself explains a lot of the investors sentiment. So SBI cards became a very bad victim of the situation and it has got nothing to do with its business.

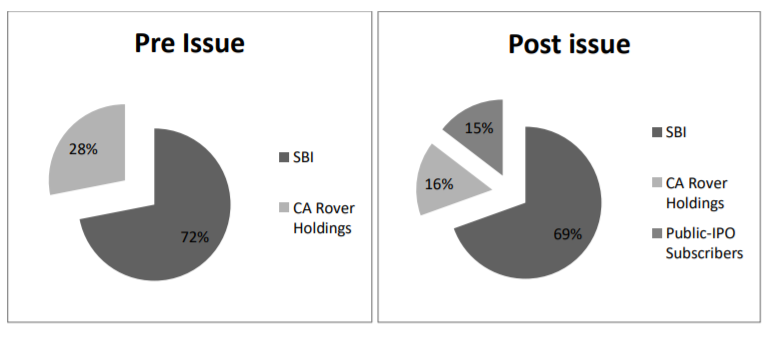

Now to understand the business model of the SBI cards and payments services let us first understand the shareholding pattern before and after the IPO issue.

Decoding the data, we can see that the company has strong backing from the State Bank of India. Thus surely we don’t see any liquidity issue in the future.

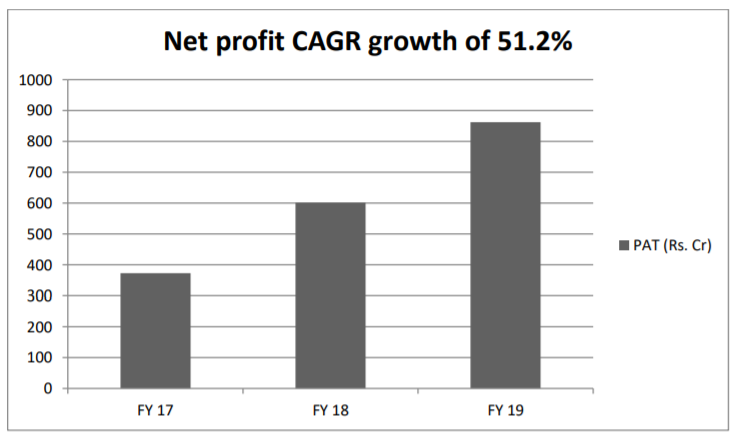

Key Financial Highlights

SBI cards have posted a brilliant year on year performance on the table. The net profit has been rising each year. In the year 2019, the company reached the milestone of distributing 9 million cards. If we consider the future scope then our study shows that there is a huge scope of its penetration in the Indian market considering India has only 3% of its population who uses a credit card as of now.

What should be your approach if you are holding SBI cards share since its IPO?

If you are someone who has got the IPO allotment and you think about a time frame of at least two years, then we think that SBI cards can generate a good return once this COVID-19 issue settles down. There will be for sure a tough road ahead for some time as the companies return will get affected by the countrywide lockdown that is going on. The malls, market and even the online e-commerce portals all are closed so the use of the cards will certainly get a hit. While 85% of its accounts belong to salaried cardholders where the NPA risk is generally low. But there is an upside risk to NPA as there can be a significant rise in the risk of job losses given the current economic situation. But despite the near term issues and impact, we are very positive about its long term outlook in the Indian market once this COVID-19 issue settles.

Happy Investing!

Disclaimer : Investing in equity market is subject to high volatility so you are always suggested to do your own research and take proper guidance from your financial advisor before investing.